All Categories

Featured

Table of Contents

You do not require to be accredited to attach Fundrise, and you absolutely do not require to spend a minimum of $25,000. Users can get going investing on Fundrise with just $10, though you will need a much higher account equilibrium to access a few of the much more exclusive deals.

You're surrendering a little bit of control in regards to choosing and managing property investments, but that might be a good idea for financiers who do not have the moment or competence to do the due persistance that Fundrise executes in your place. Low/flexible account minimums. Low charges, also compared to similar services.

Allows you invest in actual estate funds, not individual homes No control over just how funds are handled or how properties are gotten. Financial investment requires time to pay off. $100.15% yearly consultatory charge Genuine estate funds with a broad series of underlying assets5-year minimum Yieldstreet recognizes that property isn't the only alternate possession course that investors transform to when they search for return outside the equity markets.

Growth and Earnings REIT and Prism Fund are offered to unaccredited financiers. Have to be accredited to invest in many possibilities. High minimal investment limits.

What is a simple explanation of Accredited Investor Real Estate Deals?

The simple app gives capitalists the chance to obtain in on the activity. While you do require to be accredited to participate several of their costs opportunities, DiversyFund doesn't need certification to acquire into their slate of REITs and exclusive property financial investments. The financial investments they supply aren't as fluid as stocks, bonds, or many various other points you'll find on the bigger marketand acquiring in locks you in for a number of years before you can sellbut their constant returns and stable appraisals make them a perfect method to expand your tool- to lasting holdings.

Their application is developed from scratch to make spending in realty really feel smooth and instinctive. Every little thing from the spending interface to the auto-invest feature is made with convenience of use in mind, and the care they place into establishing the app beams through every tap. By the method, if you're intrigued by the idea of living in a component of your financial investment residential property and renting the remainder, residence hacking is a method you may intend to discover.

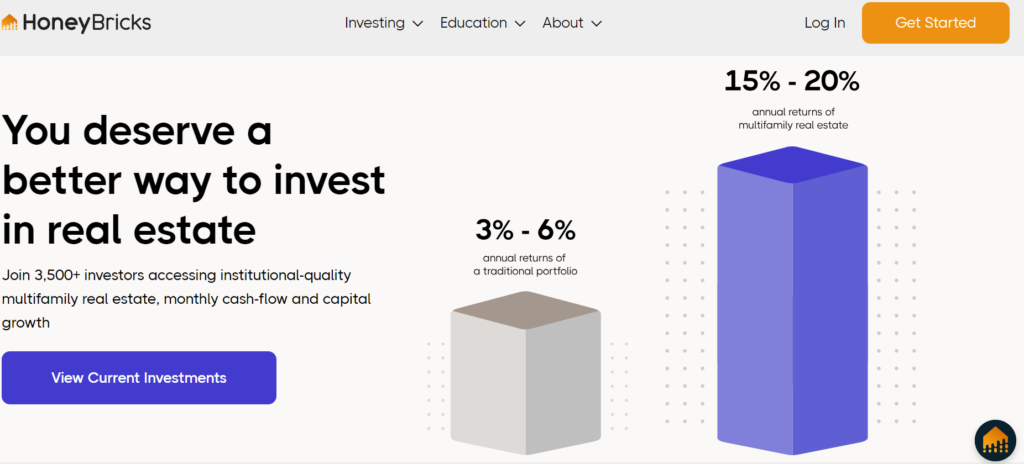

User friendly application makes investing and tracking financial investments easy. The auto-invest function lets you routine automated payments to your financial investment. Only one kind of underlying property. The biggest offers call for certification. Fairly limited impact (just 12 current multifamily assets). $500 Growth REITs; $25,000 Premier Chance Fund (certified); $50,000 Premier Direct SPVs (approved) Varies based on investmentREITs, multifamily homes, personal real estate 5 7 years EquityMultiple has this extremely self-explanatory quote on their home page from Nerdwallet: "EquityMultiple mixes crowdfunding with a more conventional property spending strategy that can lead to high returns." And though we would certainly have quit at "method" for the benefit of brevity, the Nerdwallet quote sums up EquityMultiple's total ethos quite well.

What should I know before investing in Real Estate For Accredited Investors?

Wide array of investment possibilities readily available. Opportunities are extensively vetted prior to being offered. EquityMultiple staff are always on-call to respond to concerns and fix issues. Accreditation is needed for all investments. A lot of possibilities have high minimum financial investments. Difficult to do due persistance on financial investments; need to rely on the EquityMultiple personnel.

Most individuals aren't accredited investors, so it adheres to that the majority of people do not have 5 or six figures worth of unspent capital just existing around. Once more, most of the services detailed below do need substantial minimum financial investments, but not every one of them. Spending shouldn't be the sole province of the rich, so we knowingly included solutions that don't require automobile loan-sized minimum financial investments.

No person suches as fees, so it's just natural that you 'd desire to prevent paying large administrative costs or annual service charge. That stated, companies require to make cash somehow. If they aren't charging you at the very least something for their time and initiative, after that they're probably being paid by the people whose investment chances they exist.

What are the top Private Real Estate Investments For Accredited Investors providers for accredited investors?

We desire to advise services that have your ideal rate of interests in mind, not the interests of the investment originators. This is likewise easy and was even more of a nice-to-have than a need. At the end of the day, the majority of the actual estate spending apps out there are essentially REITs that specific investors can purchase into, so we don't anticipate them to have a massive variety of investments on offer.

We provided some factor to consider to the recommended or called for size of time for each service's financial investments. Real estate returns are determined in years, not weeks or months, yet we really did not intend to recommend anything that would secure your cash up for a years or even more. Was this write-up handy? Many thanks for your feedback!.

See what catches your eye. Not every little thing is for every person yet they're all worth an appearance. Some include options offered for non-accredited investors, however examine the checklist to know without a doubt. This table offers a summary of 10 different investments, complied with by more comprehensive descriptions of every one: PlatformClass vs.

As a financier, you'll be joining the acquisition and possession of working farmland. You'll be doing it through shares acquired in the ranches. As it ends up, farmland has confirmed to be a wonderful long-term investment. This is partially due to the fact that effective farmland is limited, but the international populace is enhancing.

While it's unfavorable for customers, farmland capitalists stand to obtain. What's even more, farmland stands for ownership in a "hard asset (Real Estate Crowdfunding for Accredited Investors)." That can be a large benefit in a portfolio comprised completely of financial assets. Your investment will supply both rewards paid out of the internet rental revenue of the farm home, in addition to funding gains upon personality of the farm.

What happens if I don’t invest in Real Estate Investment Funds For Accredited Investors?

$1,000 is the requirement for the Prism Fund and short-term notes. Specific offerings need $5,000. Private offerings allow you to choose the specific assets you'll buy. For example, you can purchase various realty offers, like single-family properties or multiunit home structures. You can additionally purchase blue-chip art, business aircraft leasing, new business ships, industrial financing, and also legal offerings.

There is no administration cost, and the ordinary holding duration is 3 months. Temporary notes have no management cost at all.

Table of Contents

Latest Posts

Tax Forfeited Property

Foreclosure Overbids

List Of Unpaid Property Taxes

More

Latest Posts

Tax Forfeited Property

Foreclosure Overbids

List Of Unpaid Property Taxes